Transaction Advisory Services - An Overview

See This Report on Transaction Advisory Services

Table of ContentsSome Of Transaction Advisory ServicesAbout Transaction Advisory ServicesThe Definitive Guide to Transaction Advisory ServicesNot known Facts About Transaction Advisory ServicesThe Basic Principles Of Transaction Advisory Services

This action makes certain business looks its finest to possible customers. Obtaining business's value right is vital for an effective sale. Advisors utilize different techniques, like affordable capital (DCF) analysis, comparing to similar firms, and current deals, to figure out the reasonable market price. This helps set a fair rate and bargain efficiently with future purchasers.Purchase consultants step in to help by getting all the required details arranged, addressing inquiries from purchasers, and setting up check outs to business's location. This constructs depend on with purchasers and keeps the sale moving along. Getting the ideal terms is vital. Purchase experts utilize their knowledge to aid entrepreneur manage tough negotiations, meet customer expectations, and framework offers that match the proprietor's goals.

Fulfilling legal guidelines is crucial in any type of company sale. Purchase advisory services work with lawful experts to produce and examine contracts, arrangements, and various other lawful papers. This lowers dangers and makes certain the sale adheres to the legislation. The duty of transaction consultants extends beyond the sale. They aid local business owner in preparing for their following actions, whether it's retirement, starting a new venture, or handling their newly found wide range.

Purchase advisors bring a riches of experience and expertise, ensuring that every aspect of the sale is managed properly. Via tactical preparation, assessment, and negotiation, TAS assists entrepreneur achieve the highest feasible price. By guaranteeing legal and governing conformity and handling due persistance alongside other bargain staff member, purchase consultants decrease potential dangers and obligations.

All About Transaction Advisory Services

By comparison, Large 4 TS groups: Work on (e.g., when a possible purchaser is carrying out due persistance, or when an offer is shutting and the customer requires to incorporate the company and re-value the vendor's Annual report). Are with charges that are not linked to the offer shutting efficiently. Earn costs per interaction someplace in the, which is less than what investment banks gain also on "small offers" (but the collection chance is also a lot higher).

The interview questions are very similar to investment banking meeting concerns, but they'll concentrate much more on audit and assessment and less on subjects like LBO modeling. Expect questions about what the Adjustment in Working Resources means, EBIT vs. EBITDA vs. Web Income, and "accounting professional only" subjects like trial equilibriums and just how to go through events using debits and debts instead than economic declaration modifications.

Some Known Factual Statements About Transaction Advisory Services

Professionals in the TS/ FDD teams might also talk to monitoring concerning every little thing above, and they'll write a comprehensive report with their findings at the end of the process.

The hierarchy in Purchase Services differs a bit from the ones in financial investment banking and private equity occupations, and the basic shape resembles this: The entry-level role, where you do a whole lot of data and financial evaluation (2 years for a promotion from here). The next level up; similar work, however you get the even more fascinating bits (3 years for a promo).

Specifically, it's tough to obtain advertised beyond the Manager degree since couple of individuals leave the task at that stage, and you require to begin revealing proof of your capacity to create revenue to breakthrough. Let's begin with the hours and lifestyle considering that those are easier to explain:. There are occasional late evenings and weekend work, however absolutely nothing like the frantic nature of financial investment banking.

There are cost-of-living modifications, so anticipate reduced compensation if you remain in a less costly location outside major monetary facilities. For all settings other than Partner, the Check Out Your URL base pay comprises the bulk of the overall payment; the year-end bonus might be a max of 30% of your base pay. Usually, the very best means to increase your profits is to switch over to a various company and negotiate for a greater wage and bonus

Excitement About Transaction Advisory Services

You might get involved in business development, yet investment banking obtains harder at this phase because you'll be over-qualified for Expert roles. Business finance is still an option. At this phase, you must just remain and make a run for a Partner-level role. If you want to leave, maybe relocate to a customer and execute their appraisals and due diligence in-house.

The major issue is that since: You typically need to join one more Huge 4 team, such as audit, and work there for a few years and after that relocate into TS, job there for a couple of years and afterwards relocate into IB. And there's still no warranty of winning this IB function due to the fact that it depends upon your area, customers, and the hiring market at the time.

Longer-term, there is likewise some danger of and since reviewing a business's historic economic information is not exactly brain surgery. Yes, people will certainly constantly need to be involved, however with advanced technology, lower head counts can potentially support client involvements. That stated, the Deal Solutions team defeats audit in terms of pay, work, and departure possibilities.

If you liked this short article, you could be curious about analysis.

4 Easy Facts About Transaction Advisory Services Shown

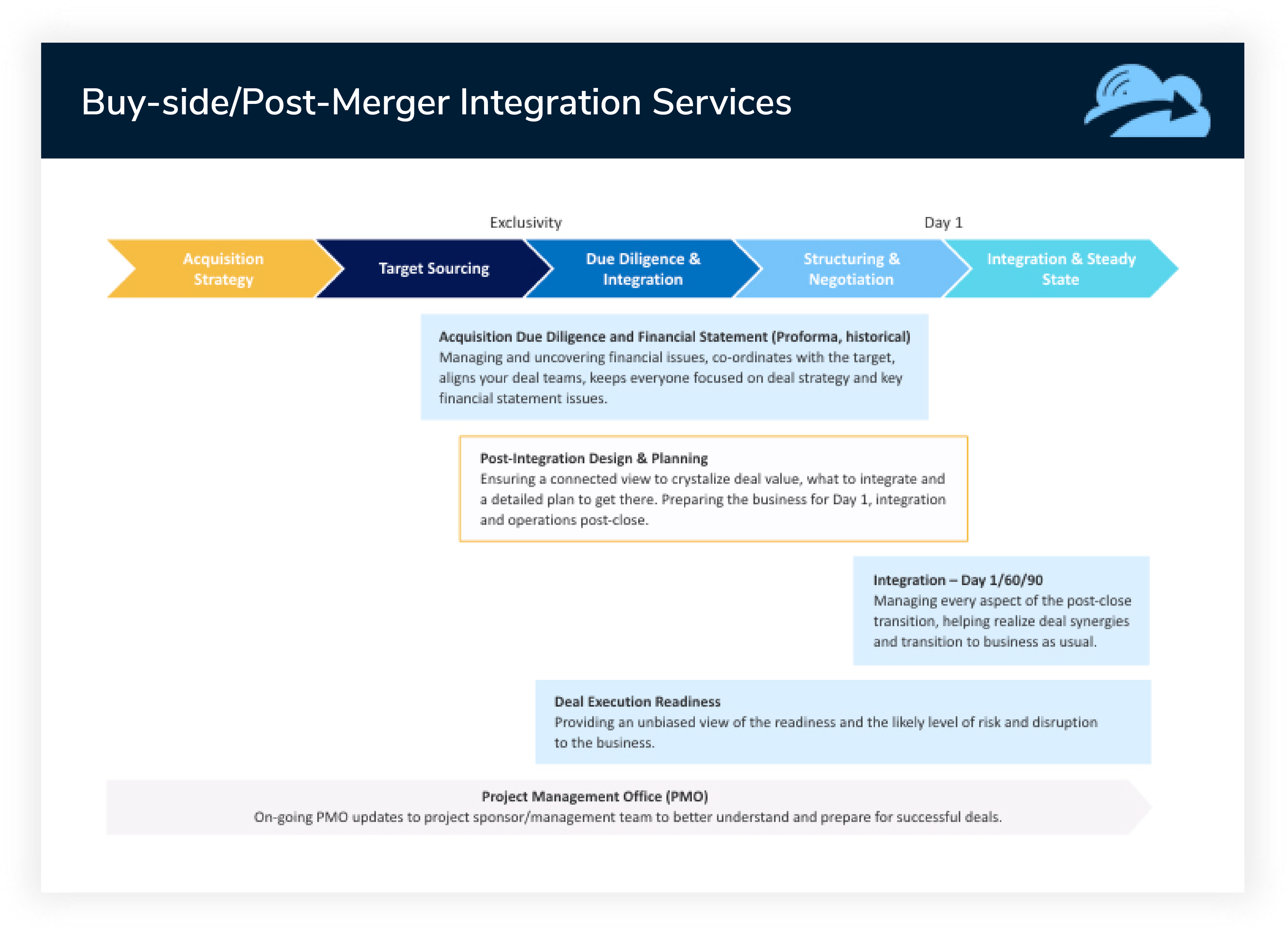

Develop sophisticated economic structures that aid in figuring out the actual market price of a company. Provide advisory work in relation to business valuation to assist in negotiating and prices structures. Explain the most ideal kind of the deal and the sort of consideration to use (cash, stock, earn out, and others).

Develop activity prepare for risk and exposure that have been recognized. Do combination planning to identify the procedure, system, and business changes that might be required after the bargain. Make mathematical estimates of integration expenses and advantages to assess the economic reasoning of assimilation. Establish guidelines for integrating divisions, innovations, and organization procedures.

Identify read review potential reductions by decreasing DPO, DIO, and DSO. Assess the potential customer base, industry verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence provides important insights into the performance of the company to be obtained worrying threat analysis and worth production. Determine short-term alterations to funds, financial institutions, Full Article and systems.